Area code Success: The Imperative Role of Settlement Processing Agents within Your Business

In today's active digital landscape, businesses must adapt quickly to meet the evolving needs with their customers. One essential aspect that can easily win or lose a company's success is repayment processing. With typically the rise of e-commerce and the improving demand for smooth transactions, having some sort of reliable payment handling agent is far more essential than ever. These agents play a huge role in ensuring of which businesses not only accept payments efficiently but also boost customer experience plus drive revenue progress.

Understanding the intricacies of settlement processing can end up being overwhelming, especially for small business owners who may absence the technical expertise. That's where settlement processing agents come in. is The Card Association legit simplify the payment process but additionally offer valuable ideas into the newest trends and systems that can keep a business competitive. As we explore the primary role of transaction processing agents, we'll uncover why joining up with the correct agent is really a strategic move that can open new opportunities for success.

The Role regarding Payment Processing Real estate agents

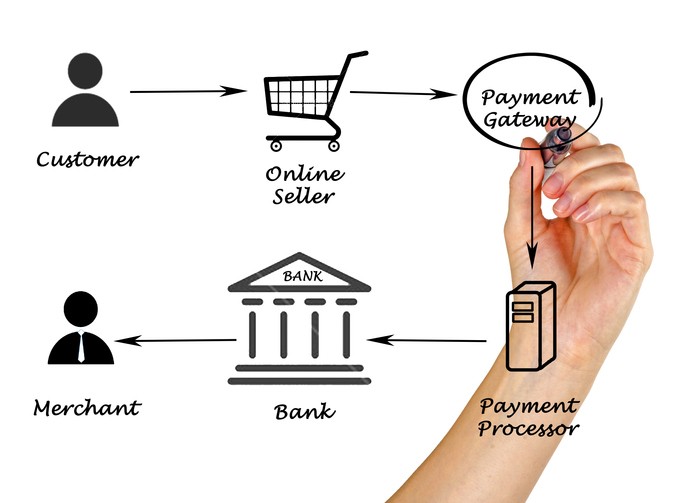

Payment processing agents work as intermediaries between retailers and financial corporations, facilitating smooth transactions which are crucial intended for business operations. They will help businesses recognize various payment approaches, including charge cards, charge cards, and electronic wallets, ensuring of which customers have a seamless experience whilst making purchases. This kind of role is crucial, particularly in today's electronic marketplace, where comfort and security are paramount for customer trust.

Furthermore, payment handling agents provide essential help in navigating typically the complexities of merchant services. They help businesses in picking the right payment solutions tailored to their specific demands, whether it entails choosing a repayment gateway or learning the intricacies of interchange fees. By leveraging their expertise, brokers can help businesses spend less and increase efficiency, pivotal aspects to be successful in some sort of competitive environment.

Moreover, payment processing agents have fun with a critical role in keeping businesses compliant with restrictions, for instance PCI complying, which is essential with regard to protecting sensitive buyer information. Additionally they stay informed about market trends and rising technologies, equipping companies with the needed tools to decrease fraud and improve customer experience. As trusted advisors, brokers help businesses not only thrive inside their current procedures but also put together for future difficulties in the ever-evolving payment landscape.

Benefits for Small Businesses

Partnering with a payment processing agent provides small businesses with usage of specialized knowledge and support that will significantly enhance their own financial operations. These agents understand the complexities of payment methods and can guideline businesses in selecting the right payment solutions focused on their specific needs. Their expertise helps to ensure that small businesses could navigate the frequently confusing landscape involving merchant services in addition to digital payment options, enabling those to focus on growth and customer service.

Additionally, repayment processing agents support small companies streamline their very own transaction processes, building it easier to enable them to manage sales in addition to receive payments efficiently. With the ideal systems in position, companies can reduce purchase times and reduce errors, which finally leads to increased customer satisfaction. Payment control agents often offer valuable insights directly into optimizing payment strategies, helping businesses eliminate bottlenecks and enhance cashflow, which is crucial for any developing enterprise.

Moreover, by using the latest repayment processing technologies in addition to trends, agents can assist small businesses within staying competitive throughout an ever-evolving industry. They can aid integrate mobile transaction solutions and assistance e-commerce platforms, enabling businesses to focus on a broader viewers and adapt in order to changing consumer conduct. This adaptability certainly not only attracts fresh customers but furthermore fosters customer dedication, as clients appreciate flexible and easy payment options.

Navigating Payment Processing Trends

As many of us move into 2024, payment processing is definitely evolving rapidly, affected by technological breakthroughs and changing consumer behaviors. One of the most considerable trends is the particular rise of cell phone payments, which have gained traction amongst consumers seeking convenience and speed. Payment processing agents need to stay informed concerning the latest mobile phone payment solutions to provide their clients with effective choices that cater to be able to the increasing requirement for street-level transactions. Understanding how in order to integrate these technologies into existing methods is vital with regard to agents looking to enhance their clients' transaction acceptance capabilities.

Another trend reshaping the landscape may be the growing value of security and compliance. With all the improving prevalence of data removes, consumers are more concerned than ever concerning the safety of their payments. Settlement processing agents should prioritize security steps such as EMV chip technology plus encryption, and guarantee their clients abide with the Payment Card Industry Info Security Standard (PCI DSS). This concentrate will not just help in lowering fraudulent transactions but also in building trust with consumers which seek secure transaction options.

Lastly, the shift towards transparent costs is another vital trend that agents must navigate. Companies are increasingly searching for clarity in payment processing costs, which can usually be convoluted. Transaction processing agents will add value simply by helping clients realize interchange fees, invisible charges, and give direction on securing the most effective payment processing rates. By fostering an environment of transparency, providers can help companies build better associations using their customers in addition to establish a fair pricing structure that drives growth.